Failure to complete your registration on the goAML system may lead to significant penalties enforced by the Ministry of Economy. While the Ministry of Economy initially set April 30, 2021, as the deadline for registration, they are currently still accepting registrations.

Anti Money Laundering and Counter Terrorism Financing

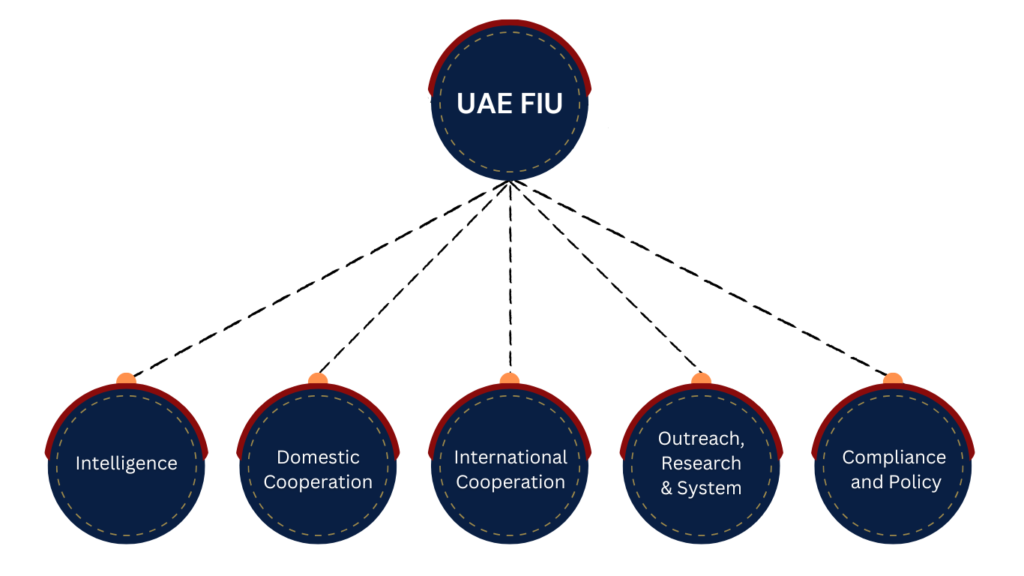

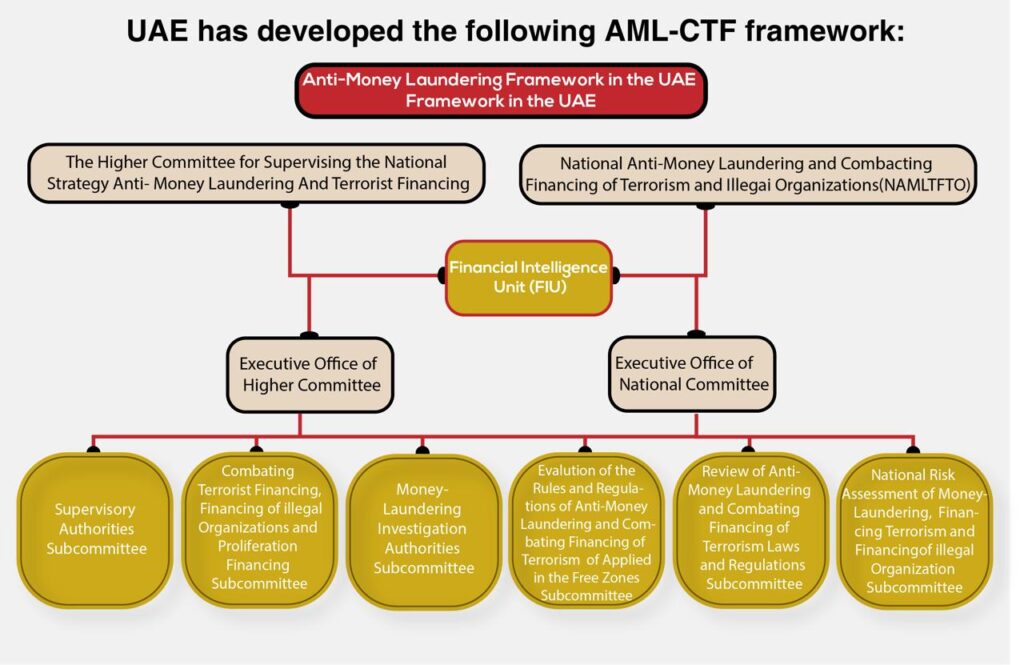

The United Arab Emirates (UAE) has been diligently working on strategies to combat illegal funding of organizations and money laundering activities, all while adhering to international standards set by the Financial Action Task Force (FATF). To accomplish this mission, the UAE established the Financial Intelligence Unit (FIU) under the Central Bank of the UAE (CBUAE). Consequently, the FIU’s primary role is to regulate and monitor entities, both directly and indirectly involved in facilitating such activities within the country’s economy.

As part of this initiative, Federal Decree-law no. 20 of 2018 on Money Laundering, Financing Terrorism, and Illegal Organizations was introduced. This new law superseded the previously issued Federal Decree-Law no. 4 of 2002.

It is crucial to emphasize that all regulated entities, including financial institutions (FIs) and Designated Non-Financial Businesses and Professionals (DNFBPs), are required to implement robust Anti-Money Laundering and Counter-Terrorist Financing (AML-CTF) policies and controls throughout their operations. Equally important is the need to thoroughly document these measures.

What Is Money Laundering?

Money laundering comprises three fundamental phases, and it is imperative for all regulated entities to vigilantly identify specific indicators that may raise suspicions, necessitating monitoring and further investigation.

As articulated by the Ministry of Economy, money laundering is defined as any financial or banking transaction devised to obfuscate or disguise the origin of unlawfully acquired funds, with the intent to evade their detection within the financial and banking systems, subsequently reintegrating them into the financial realm.

These three phases are as follows:

- Placement: Involves the act of introducing illicitly obtained funds into the formal financial systems.

- Layering: Entails a series of complex financial transactions aimed at concealing the illicit origin of the proceeds, often involving intricate and convoluted financial maneuvers.

- Integration: Encompasses the creation of a facade of legitimate origin for the illicit proceeds, thereby rendering them seemingly legal within the financial framework.

Money Laundering Offenses and Definitions

The Decree-Law, in its provisions, defines an individual culpable of a money-laundering offense as someone who is fully aware that the money in question originates from a criminal act. With this understanding, they intentionally engage in one of the following actions:

- Transmitting or transporting proceeds of criminal activity with the explicit intent to conceal their illicit source.

- Concealing or camouflaging the true nature, origin, location, method of disposition, movement, or rights associated with any proceeds or their ownership.

- Acquiring, possessing, or utilizing such illicit proceeds.

- Assisting the perpetrator of the underlying criminal offense in evading punishment.

These definitions and phases serve as the cornerstone for critical efforts to combat and deter money laundering, ultimately ensuring the integrity and transparency of financial systems.

Regulated Entities For goAML

Financial Institutions (FIs) and Designated Non-Financial Businesses and Professionals (DNFBPs) registered in the United Arab Emirates (UAE) bear specific obligations that must be diligently adhered to in order to ensure compliance with the prevailing laws and regulations. Failure to meet these obligations can result in legal violations and associated penalties.

First and foremost, it is imperative for these entities to complete the registration process on the goAML system. The Financial Intelligence Unit (FIU) has developed the goAML system to streamline the reporting of suspicious transactions and activities, facilitating a more convenient process for regulated entities.

Furthermore, the following key steps must be taken:

- Appointment of an Independent and Qualified Compliance Officer: Each entity is required to designate a compliance officer who possesses the requisite qualifications and independence to oversee compliance matters effectively.

-

Development and Implementation of Robust Internal Controls, Policies, and Procedures:

This entails the formulation and enactment of comprehensive internal controls, policies, and procedures. These should encompass the following areas:

- Customer and Employee Due Diligence, often referred to as Know Your Customer (KYC) and Know Your Employee (KYE).

- Screening of customers against sanction lists.

- Ongoing monitoring and training programs.

- Conducting thorough customer due diligence.

- Implementing risk management procedures.

- Reporting of suspicious transactions.

- Enrollment in an automated system for reporting sanctions lists.

Policies and Procedures

The Ministry of Economy is set to carry out regular inspections of all DNFBPs with the aim of evaluating the extent to which these obligations are being met. In pursuit of this goal, measures will be taken to ensure compliance, with any violations subject to penalties as stipulated by the regulations.

These policies and procedures can be categorized into several key areas:

- Customer Acceptance Policies and Risk Assessment/Categorization: Setting clear criteria for customer acceptance and categorizing risk levels appropriately.

- Know Your Customer (KYC) Policy: Implementing due diligence measures for accurate customer identification and verification.

- Customer Screening Against Sanction Lists: Regularly screening customers against national and international sanction lists to identify potential risks.

- Monitoring Policy and Suspicious Transaction Reporting: Establishing procedures for ongoing monitoring of transactions and reporting any that appear suspicious.

- Know Your Employee (KYE) Policy: Understanding employees’ roles, responsibilities, and background to prevent internal risks.

- Staff Training Policy: Conducting regular training sessions to enhance awareness and understanding of AML/CFT compliance measures among staff.

- Compliance Officer and Independent Internal Audits: Appointing a qualified compliance officer and conducting independent internal audits to assess and improve compliance performance.